Some states have outsize insurance requirements for ridesharing

State laws around the US require rideshare drivers to have commercial auto insurance. This is necessary because personal auto insurance typically doesn’t cover accidents that occur while earning on platforms like Uber. Each state sets its own commercial auto insurance requirements, which vary dramatically by state. While most states permit the driver, Uber, or a combination of both to satisfy these requirements, Uber buys commercial auto insurance for drivers so they don’t have to pay for expensive annual policies themselves. Learn more about Uber’s insurance coverage here.

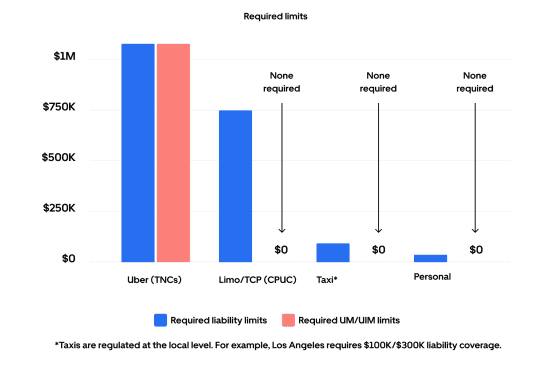

Rideshare drivers commonly have higher commercial auto insurance coverage requirements than other vehicles on the road, including taxis, limousines, and commercial livery vehicles. In California, for example, the $1 million liability coverage requirement imposed on Uber and other TNCs (transportation network companies) is currently more than 30 times that of personal vehicles on the road, which is required at just $30,000 per person. It’s also far higher than that required of taxis, at 10 times the LA and San Francisco coverage requirements per person (taxi requirements change from city to city). In 2020, the City of San Francisco temporarily lowered the liability insurance requirements for taxis from $1 million to $100,000 per person and $300,000 per accident to help with pandemic recovery, and it has not yet reverted to previous levels. In Nevada and New Jersey, TNC trips are required to have $1.5 million in liability coverage, which is 30 times the $50,000 requirement per incident for personal vehicles. It’s also significantly larger than the $1 million liability coverage requirement for rideshare trips in most other states.

Requiring insurance for when someone else is at fault

In addition to these high liability requirements, 5 states also require $1 million or more in coverage that applies when other drivers, not the rideshare driver, are at fault and don’t have enough or any insurance. This is called uninsured/underinsured motorist insurance (UM/UIM). In California, TNC drivers are required to have $1 million in UM/UIM coverage while a passenger is in the vehicle, but there’s no requirement for other road users.

Similarly, New York State has a UM/UIM requirement for personal car owners, but, at $50,000 per incident, that requirement is 25 times lower than the $1.25 million requirement for TNC trips in New York.¹ In New Jersey, the $1.5 million TNC requirement for UM/UIM is 50 times the requirement for personal car owners. These outsize requirements contribute to the increasing burden of high insurance costs on consumers.

How unfair insurance requirements affect rideshare riders

Riders feel the impact directly through the cost of their trips, and riders in states with very high insurance requirements pay more than riders do in states with more reasonable requirements. In California and New Jersey, for example, nearly one-third of the rider’s fare goes to pay for state-mandated insurance costs. More than half of that total is due to the UM/UIM requirement alone. In New York State, where the TNC liability requirement matches the UM/UIM requirement at $1.25 million, 25% of the rider’s fare on average goes to mandatory insurance costs. In comparison, in places like Washington, DC, and Massachusetts, less than 5% of riders’ fares goes to mandatory insurance costs.²

Legal abuse can lead to skyrocketing insurance costs

Special interests in some states are exploiting TNC insurance rules for their own gain. High insurance limits have made the rideshare industry a target for personal injury lawsuits, even in cases where neither drivers nor Uber are at fault. Fraudulent claims and outsize settlements inflate costs, driving up insurance premiums year over year. Insurance companies pass these costs on to the insured.

For example, costs associated with Uber’s US rides insurance have increased by roughly 50% per trip in the last 3 years, even as Uber saw a decrease in the rate of overall crashes reported on the platform from 2017 to 2022. This outsize increase in the cost of insurance affects TNC riders and drivers directly, since estimated insurance costs are included in the rider’s fare.

The insurance crisis isn’t confined to the rideshare industry. Over the last 3 years, personal vehicle owners have seen a 30% increase in the cost of motor vehicle insurance across the US, according to the Consumer Price Index. And the American Tort Reform Association found that abuse of the legal system costs each American $1,424 annually, almost $6,000 for a family of four.

Safer outcomes with Uber

Over the years, we’ve consistently raised the bar on safety by developing industry-first features; comprehensive education for our users; and close partnerships with experts, including advocates and law enforcement, who help guide our decisions.

Uber has already invested in safety innovations like left-turn reductions, partially controlled intersection alerts, and seat-belt alerts, with the goal of minimizing risk from crashes. Uber has also launched Driving Insights, a dashboard that provides drivers with visibility into their driving habits and tips to improve their driving safety. There's a strong body of research that points to TNC drivers being safer than the average driver, contributing to road safety. Per 100 million vehicle miles traveled, Uber’s motor vehicle fatality rate is significantly lower than the national average, and 99.9% of Uber trips occur without any safety-related incident at all.

Studies have also shown that Uber’s presence in a city reduces the rate of drinking-and-driving crashes. And because of ridesharing, traffic fatalities on nights and weekends have decreased. A national study published in The Review of Economics and Statistics showed that Uber reduced overall traffic fatalities in the US by 5.2%, equating to 627 lives saved in 2019 alone. Finally, according to a Mothers Against Drunk Driving survey, 78% of people agree that their friends are less likely to drive drunk if ridesharing is available.³

Necessary reforms

Uber is leading advocacy efforts across the country to push for and pass commonsense legislative changes that keep all trips covered while bringing down costs so more of the rider’s fare ends up where it belongs: in the driver’s pocket. By rationalizing TNC insurance requirements, we’ll be able to ensure that consumers are paying only for the protections they need.

What can you do?

Get involved in advocacy

Your voice matters. Join our efforts to advocate for fairer insurance policies in your state.

Stay informed

Each US state has its own requirements for TNC insurance. Explore the latest through our map below, and learn about the states that have the most onerous requirements.

Does your state have high insurance costs for ridesharing?

In most of the country, mandatory insurance costs per Uber trip are 10% or less of the average rider fare. Explore below to discover how mandatory insurance costs per trip break down for the top 9 most expensive states for insurance costs in the country.⁴

- California: 32% (43% for Los Angeles County)

Why such a high percentage?

California mandates that TNCs must have at least $1 million per incident of uninsured motorist/underinsured motorist (UM/UIM) coverage while a passenger is in the vehicle, while no other driver on the road—not even taxis in Los Angeles or San Francisco—are required to have any UM/UIM coverage. UM/UIM costs are especially high in Los Angeles County. UM/UIM coverage only applies when another driver, not the rideshare driver, is at fault.

These high limits invite litigation abuse, where a cottage industry of trial attorneys target TNCs.

- Colorado: 13%

Down Small Why such a high percentage?

Colorado mandates that TNCs must have at least $200,000 per person and $400,000 per incident of uninsured motorist/underinsured motorist (UM/UIM) coverage when en route or on trip, while no other driver on the road—not even taxis—are required to have any UM/UIM coverage. UM/UIM coverage only applies when another driver, not the rideshare driver, is at fault.

These high limits invite litigation abuse, where a cottage industry of trial attorneys target TNCs.

- Florida: 21%

Down Small Why such a high percentage?

Runaway lawsuit abuse in Florida acts as a “social tax,” inflating costs, including insurance costs, for businesses and consumers alike. Legal reforms passed in 2023 have shown positive signs of stabilizing costs, and maintaining these reforms can help reduce cost burdens and promote fairness.

- Georgia: 23%

Down Small Why such a high percentage?

Georgia mandates TNCs to have at least $100,000 per person and $300,000 per incident in coverage for uninsured motorist/underinsured motorist (UM/UIM) coverage when a passenger is in the vehicle, when no other driver on the road—even taxis in Atlanta—are required to have any UM/UIM coverage. UM/UIM coverage only applies when another driver, not the rideshare driver, is at fault.

These high limits invite litigation abuse, where a cottage industry of trial attorneys target TNCs.

- Louisiana: 28%

Down Small Why such a high percentage?

Louisiana has the highest insurance costs per mile of all US states. Why? Unbridled lawsuits drive up insurance premiums for everyone. In fact, legal system abuse in Louisiana costs every resident more than $1,100 annually, according to an analysis by the American Tort Reform Association. Legal reform can help reduce these burdens and promote fairness.

- Nevada: 21%

Down Small Why such a high percentage?

In Nevada, TNCs are required to have $1.5 million in liability coverage when a passenger is in the vehicle, which is 30 times the $50,000 requirement per incident for personal vehicles, and also significantly larger than the $1 million liability coverage requirement for rideshare trips in the majority of other states.

- New Jersey: 32%

Down Small Why such a high percentage?

In New Jersey, TNCs are required to have $1.5 million in liability coverage when a passenger is in the vehicle, which is 30 times the $50,000 requirement per incident for personal vehicles, and also significantly larger than the $1 million liability coverage requirement for rideshare trips in the majority of other states.

In addition, New Jersey requires TNCs to have $1.5 million for uninsured motorist/underinsured motorist (UM/UIM) coverage when a passenger is in the vehicle, which is 50 times the requirement for personal car owners and not required at all for taxis or limousines. UM/UIM coverage only applies when another driver, not the rideshare driver, is at fault.

These high limits invite litigation abuse, where a cottage industry of trial attorneys target TNCs.

- New York State (excluding New York City): 25%

Down Small Why such a high percentage?

New York State (excluding New York City) has an uninsured motorist/underinsured motorist (UM/UIM) requirement for personal car owners, but at $50,000 per incident that requirement is 25 times lower than the $1.25 million requirement for TNCs in New York when a passenger is in the vehicle. These outsize requirements contribute to the increasing burden of high insurance costs on consumers.

New York also has a requirement for TNCs of $1.25 million in liability coverage when a passenger is in the vehicle, which is significantly higher than the $1 million liability coverage requirement for rideshare trips in the majority of other states.

These high limits invite litigation abuse, where a cottage industry of trial attorneys target TNCs.

- Texas: 14%

Down Small Why such a high percentage?

Runaway lawsuit abuse by plaintiffs’ firms that target ridesharing’s high insurance requirements for outsize settlements contribute to the very high costs of insurance in Texas. The tort dynamics in Texas are favorable to plaintiffs and trial lawyers and can result in very high settlements, including nuclear verdicts. These factors act as a “social tax,” inflating costs—including insurance costs—for businesses and consumers alike.

¹This requirement for TNCs is only while a passenger is in the vehicle.

²Data for California, Massachusetts, New York, New Jersey, and Washington, DC, is sourced from Uber internal figures as of December 2024. Data related to these figures will fluctuate and be updated on this page after each quarter.

³Mothers Against Drunk Driving (MADD) data referenced in a 2020 letter from MADD to California Gov. Gavin Newsom.

⁴Based on Uber data from December 2024 for rideshare/TNC (transportation network company) trips taken through Uber.

À propos